Flexible Spending Medical & Dependent Care

FSAs provide you with an important tax advantage that can help you pay for non-reimbursed health care and dependent care on a pre-tax basis. By anticipating your health care and dependent care, for the next year, you can lower your taxable income.

For each of the FSAs you’ve elected, you can set aside funds out of each pay period paycheck before paying income taxes. Then, during the year you can use money from your account(s) to for certain IRS-approved expenses (see www.irs.gov or http://www.wexinc.com/insights/benefits-toolkit/eligible-expenses) for a complete list of qualified expenses).

Set your contribution amount at the beginning of the year. After that, you cannot change it unless you have a qualifying life event. Additionally, due to the “use or lose” rule, if you do not use the full amount set aside in the account at the end of the year, the remaining money will be forfeited.

FSA: Health Care Account

- 2026 Contribution Limit: Up to $3,400 per year

- For you, your spouse, dependent children, and any dependent who is physically or mentally incapable of caring for himself/herself

- Co-pays and deductibles

- Over-the-counter medications

- Vitamins (you will need a written prescription from your medical provider for these to be covered)

- Vision services, including contact lenses, eye exams, prescription eyeglasses, and co-pays/deductibles

- Dental expenses, including orthodontics and co-pays/deductibles

FSA: Dependent Care Account

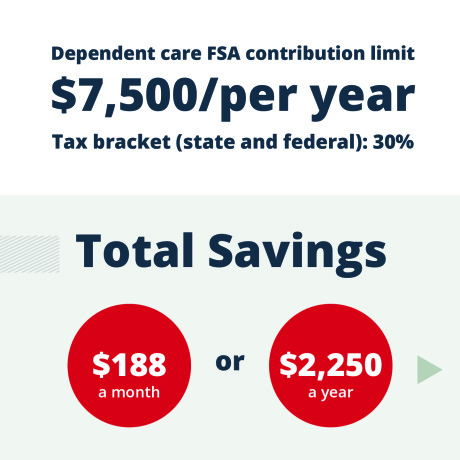

- 2026 Contribution Limits: Up to $7,500 per household per year ($3,750 if married and filing separately)

- For children under age 13; a dependent or spouse who is physically or mentally incapable of caring for himself/herself; or elder care

- Fully licensed day care, summer day camps, or before and after school programs

- Remember, if you do not exhaust your account balance by the end of the year, the unused balance is forfeited – the IRS does not permit the money to rollover into the next year