Voluntary Life and AD&D Insurance

Since every employee has different needs when it comes to life insurance, New Castle County provides you with the opportunity to apply and purchase for Voluntary Life Insurance through Hartford Life and Accident Insurance Co. This plan is 100% employee paid via payroll deductions.

- You can purchase supplemental Life and AD&D insurance in increments of $10,000.

- The maximum amount you can purchase cannot be more than 5 times your annual earnings or $500,000. Annual earnings are as defined in The Hartford’s contract with your employer.

- Employee must elect coverage in order to elect coverage for dependents. The coverage must be at least $10,000 for children or closest equal amount for your spouse.

If you are electing coverage after your initial offering, or electing to increase your current coverage, you will need to provide evidence of insurability that is satisfactory to The Hartford Insurance before coverage can become effective.

Voluntary Spouse Life & AD&D Insurance

If you elect supplemental life and AD&D insurance for yourself, you may choose to purchase spouse supplemental life and AD&D insurance in increments of $5,000, to a maximum of $50,000.

If applying for additional coverage outside of the initial offering, your spouse will need to provide evidence of insurability that is satisfactory to The Hartford before the excess can become effective. If you were previously eligible and are electing coverage for the first time or electing to increase your current coverage, you will need to provide evidence of insurability that is satisfactory to The Hartford before coverage can become effective.

Voluntary Child Life & AD&D Insurance

If you elect supplemental life and AD&D insurance for yourself, you may choose to purchase child(ren) supplemental life and AD&D insurance coverage in the amount(s) of $5,000 for each child – no medical information is required.

- Your child(ren) must be from Live Birth but not yet age 26 to be covered.

- Child(ren) age 26 or older may be covered if they were disabled prior to attaining age 26.

- Child(ren) from live birth but not yet age 6 months are limited to a reduced benefit of $1,000.

Why Do I Need Life Insurance?

Ask yourself this: In the event of my death, how would my family …

- Pay final expenses?

- Pay off debt?

- Pay for daily living expenses (housing, food, bills, etc.)?

- Replace Your Income?

- Maintain financial stability?

Short-Term Disability Insurance

Short term Disability Insurance replaces part of your monthly income if you can’t work because of a covered injury, illness or childbirth. How long you can recover benefits will depend on your plan and how long you are disabled. See Certificate of Coverage for benefit duration.

You: You are eligible for coverage if you are an active employee* in the United States working a minimum of 35 hours per week. Choose a monthly benefit between $400 and $5,000 for covered disabilities due to injury or illness. Coverage of up to 60% of your gross monthly salary may be offered. You may have to answer some additional health questions.

Elimination period (EP) and Benefit duration (BD) You can choose from 0/14/6 or 14/14/6 plans. The first number is the elimination period for a covered off-the-job accident. The second number is the elimination period for an illness. And the third number is your benefit duration. Elimination period is the number of days that must pass between your first day of a covered accident or illness and the day you can start receiving disability benefits. Benefit duration is the number of months you could receive benefits while you are disabled.

Long-Term Disability Insurance

Long Term Disability Insurance replaces part of your income if you are sick or injured for an extended period. It can pay a monthly benefit as long as you are considered disabled, according to your policy. These benefits could be reduced if you are also receiving other replacement income sick as Social Security Disability Insurance. See Certificate of Coverage for benefit duration.

You: You are eligible for coverage if you are an active employee in the United States working a minimum of 35 hours per week. Coverage amounts Choose from $200 to $1,400 a month, in $100 increments. You can cover up to 60% of your monthly income. The monthly benefit may be reduced or offset by other sources of income.

Elimination period (EP) Your elimination period is 180 days. This is the number of days that must pass after a covered accident or illness before you can begin to receive benefits.

Benefit duration (BD) This is the maximum length of time you can receive benefits while you’re disabled. You can receive benefits up to the Social Security (SS) normal retirement age.

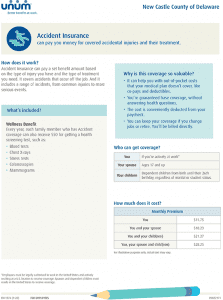

Voluntary Accident Insurance

Accidents can happen at any moment throughout the day, whether at work or at play. Most major medical insurance plans only pay a portion of the bills. Our policy can help pick up where other insurance leaves off and provide cash to cover the expenses. Our accident coverage helps offer peace of mind when an accidental injury occurs.

Who can get coverage?

You: If you’re actively at work*

Your spouse: Ages 17 and up

Your children: Dependent children from birth until their 26th birthday, regardless of marital or student status.

Voluntary Critical Illness Insurance

The signs pointing to a critical illness are not always clear and may not be preventable, but our coverage can help offer financial protection in the event you are diagnosed. Unum Life Insurance Company of America group voluntary critical illness coverage provides a lump-sum cash benefit to help you cover the out-of-pocket expenses associated with a critical illness.

Who can get coverage?

You: Choose $10,000, $20,000 or $30,000 of coverage. Coverage is guaranteed up to $30,000 if you apply during this enrollment.

Your spouse: Spouses from age 17 and up can get $5,000, $10,000 or $15,000 of coverage during this enrollment. Coverage is guaranteed up to $15,000 with no medical questions as long as you have purchased coverage for yourself.

Your children: Dependent children from newborns to age 26 are automatically covered at no extra cost. Their coverage amount is 50% of yours. They are covered for all the same illnesses, plus these specific childhood conditions: cerebral palsy, cleft lip or palate, cystic fibrosis, Down syndrome and spina bifida. The diagnosis must occur after the child’s coverage effective date.

Voluntary Hospital Indemnity Insurance

Hospital Insurance can pay you a benefit when you are admitted to the hospital for a covered injury or illness. It can help with out of pocket expenses medical insurance may not cover such as co-pays and deductibles. You decide how to spend the money. Coverage is also available for your spouse and children.

What’s included?

- $1,000 for each covered hospital admission – once per year

- $100 for each day of your covered hospital stay, up to 60 days – once per year

- $200 for each day you spend in intensive care, up to 15 days – once per year

Who Can Get Coverage?

You: If you’re actively at work

Your spouse: Ages 17 and up

Your children: Dependent children until their 26th birthday, regardless of marital or student status.

Whole Life Insurance

Can pay money to your family if you die. It can help them with basic living expenses, final arrangements, tuition and more.

How does it work?

You can keep Whole Life Insurance as long as you want. Once you’ve bought coverage, your cost won’t increase as you age. The benefit amount stays the same, too — it doesn’t decrease as you get older. That means you get protection during your working years and into retirement. Whole Life Insurance also builds cash value at a guaranteed rate of 3.75%.* You can borrow from that cash value, or you can buy a smaller, paid-up policy — with no more premiums due.

What’s included?

A “Living” Benefit you can request an early payout of your policy’s death benefit (up to $150,000 maximum) if you’re diagnosed with a terminal illness and expected to live 12 months or less. It can help cover your costs while you’re still alive. The payout would reduce the benefit that’s paid when you die. Long Term Care Rider You may be able to use your death benefit to pay for long term care. Subject to rider conditions. Contact UNUM on 855-938-1329 or www.unum.com for more information.

Who can get coverage?

You: You can purchase $2,000 – $200,000 in increments of $5,000 of coverage for yourself.

Your spouse: Individual coverage is Available for your spouse between the ages of 15 to 80, even if you don’t purchase coverage for yourself. If you leave your employer, you can keep this coverage and be billed at home. You can purchase $2,000 – $50,000 in increments of $5,000 of coverage for your spouse.

Your children: Individual coverage Your children can have individual coverage, even if you don’t get coverage for yourself. If you leave your employer, your children can keep their coverage. You can purchase a benefit amount of $5,000 – $25,000 in increments of $5,000 of coverage for each child.

Flexible Spending Medical & Dependent Care

FSAs provide you with an important tax advantage that can help you pay for non-reimbursed health care and dependent care on a pre-tax basis. By anticipating your health care and dependent care, for the next year, you can lower your taxable income.

For each of the FSAs you’ve elected, you can set aside funds out of each pay period paycheck before paying income taxes. Then, during the year you can use money from your account(s) to for certain IRS-approved expenses (see www.irs.gov or http://www.wexinc.com/insights/benefits-toolkit/eligible-expenses) for a complete list of qualified expenses).

Set your contribution amount at the beginning of the year. After that, you cannot change it unless you have a qualifying life event. Additionally, due to the “use or lose” rule, if you do not use the full amount set aside in the account at the end of the year, the remaining money will be forfeited

FSA: Health Care Account

- 2025 Contribution Limit: Up to $3,300 per year

- For you, your spouse, dependent children, and any dependent who is physically or mentally incapable of caring for himself/herself

- Co-pays and deductibles

- Over-the-counter medications

- Vitamins (you will need a written prescription from your medical provider for these to be covered)

- Vision services, including contact lenses, eye exams, prescription eyeglasses, and co-pays/deductibles

- Dental expenses, including orthodontics and co-pays/deductibles

FSA: Dependent Care Account

- 2025 Contribution Limits: Up to $5,000 per household per year ($2,500 if married and filing separately)

- For children under age 13; a dependent or spouse who is physically or mentally incapable of caring for himself/herself; or elder care

- Fully licensed day care, summer day camps, or before and after school programs

- Remember, if you do not exhaust your account balance by the end of the year, the unused balance is forfeited – the IRS does not permit the money to rollover into the next year