Please select your age group for the benefits that apply to you and your dependents.

Under 65

Retirees under 65 along with their spouse and or dependent children are eligible for the benefits described below.

- Medical (spouse, and/or children up to age 26)

- scroll down for medical plan information

- Dental (spouse and/or children up to age 26)

- click here for the Dental Plan page

- Vision (spouse and/or children up to age 26)

- click here for the Vision Plan page

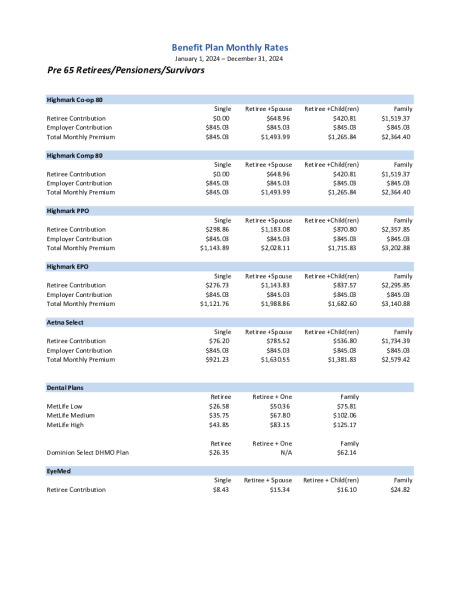

Medical Plan Comparison

New Castle County will continue to offer medical coverage. The below charts are a brief outline of the plan options.

Please CLICK HERE or scroll down for the Aetna or BCBS Retiree Plan.

Highmark BlueCross BlueShield Plans

| Highmark Blue Cross Blue Shield Highmark PPO |

Highmark Blue Cross Blue Shield Highmark EPO |

Highmark Blue Cross Blue Shield Highmark Comp 80 |

||||||

|---|---|---|---|---|---|---|---|---|

| In-Network Benefits |

Out-of-Network Benefits |

Schedule of Benefits | Schedule of Benefits | |||||

| Annual Deductible | ||||||||

| Individual | $200 | $200 | $0 | $200 | ||||

| Family | $400 | $400 | $0 | $400 | ||||

| Coinsurance | 100% | 80% | 100% | 80% | ||||

| Maximum Out-of-Pocket | ||||||||

| Individual | $9,450 | N/A | $9,450 | $9,450 | ||||

| Family | $18,900 | N/A | $18,900 | $18,900 | ||||

| Physician Office Visit | ||||||||

| Primary Care | $25 copay | 80% after deductible | $25 copay | 80% after deductible | ||||

| Specialty Care | $35 copay | 80% after deductible | $35 copay | 80% after deductible | ||||

| Preventive Care | ||||||||

| Adult Periodic Exams/ Well Child Care | 100% | Not covered | 100% | 100% | ||||

| Diagnostic Services | ||||||||

| X-ray and Lab Tests | 100% | 80% after deductible | 100% | 100% | ||||

| Complex Radiology | 100% | 80% after deductible | 100% | 100% | ||||

| Urgent Care Facility | $25 copay | 80% after deductible | $25 copay | 80% after deductible | ||||

| Emergency Room Facility Charges | $100 copay per visit; waived if admitted | $100 copay per visit; waived if admitted | $100 copay per visit; waived if admitted | 100% | ||||

| Inpatient Facility Charges | 100% | 80% after deductible | 100% | 100% | ||||

| Outpatient Facility and Surgical Charges | 100% | 80% after deductible | 100% | 100% | ||||

| Mental Health | ||||||||

| Inpatient | 100% | 80% after deductible | 100% | 100% | ||||

| Outpatient | 100% | 80% after deductible | 100% | 80% after deductible | ||||

| Substance Abuse | ||||||||

| Inpatient | 100% | 80% after deductible | 100% | 100% | ||||

| Outpatient | 100% | 80% after deductible | 100% | 80% after deductible | ||||

| Retail Pharmacy (30 Day Supply) | ||||||||

| Generic | $8 copay | Not covered | $8 copay | 20% after deductible | ||||

| Preferred | $30 copay | Not covered | $30 copay | 20% after deductible | ||||

| Non-Preferred | $50 copay | Not covered | $50 copay | 20% after deductible | ||||

| Mail Order Pharmacy (90 Day Supply) | ||||||||

| Generic | $16 copay | Not covered | $16 copay | 20% after deductible | ||||

| Preferred | $60 copay | Not covered | $60 copay | 20% after deductible | ||||

| Non-Preferred | $100 copay | Not covered | $100 copay | 20% after deductible | ||||

Note: Please consult plan documents for full benefits, exclusions, and limitations.

Medical Insurance (continued)

Highmark BlueCross BlueShield Plans

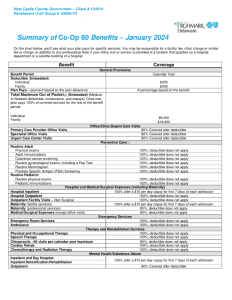

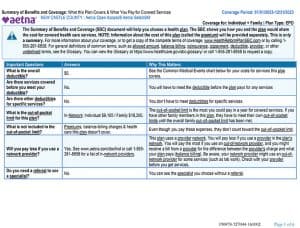

| Aetna Open Access Select | Highmark Blue Cross Blue Shield Highmark Co-Op 80 (Retiree Only) |

|||

|---|---|---|---|---|

| Schedule of Benefits | Schedule of Benefits | |||

| Annual Deductible | ||||

| Individual | $0 | $200 | ||

| Family | $0 | $400 | ||

| Coinsurance | 100% | 80% | ||

| Maximum Out-of-Pocket | ||||

| Individual | $9,450 | $9,450 | ||

| Family | $18,900 | $18,900 | ||

| Physician Office Visit | ||||

| Primary Care | $25 copay | 80% after deductible | ||

| Specialty Care | $35 copay | 80% after deductible | ||

| Preventive Care | ||||

| Adult Periodic Exams | 100% | 100% | ||

| Well-Child Care | 100% | 100% | ||

| Diagnostic Services | ||||

| X-ray / Lab Tests | 100% | 100% | ||

| Complex Radiology | 100% | 100% | ||

| Urgent Care Facility | $25 copay | 80% after deductible | ||

| Emergency Room Facility Charges | $100 copay; waived if admitted | 100% | ||

| Inpatient Facility Charges | 100% | $10 copay per day for first 7 days then 100% | ||

| Outpatient Facility and Surgical Charges | 100% | 100% | ||

| Mental Health | ||||

| Inpatient | 100% | $10 copay per day for first 7 days then 100% | ||

| Outpatient | 100% | 80% after deductible | ||

| Substance Abuse | ||||

| Inpatient | 100% | $10 copay per day for first 7 days then 100% | ||

| Outpatient | 100% | 80% after deductible | ||

| Other Services | ||||

| Chiropractic | 80% after deductible; 30 visits per year | 80%; 30 visits per year | ||

| Retail Pharmacy (30 Day Supply) | ||||

| Generic | $8 copay | 20% after deductible | ||

| Preferred | $30 copay | 20% after deductible | ||

| Non-Preferred | $50 copay | 20% after deductible | ||

| Mail Order Pharmacy (90 Day Supply) | ||||

| Generic | $16 copay | 20% after deductible | ||

| Preferred | $60 copay | 20% after deductible | ||

| Non-Preferred | $100 copay | 20% after deductible | ||

Note: Please consult plan documents for full benefits, exclusions, and limitations.

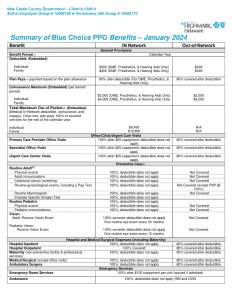

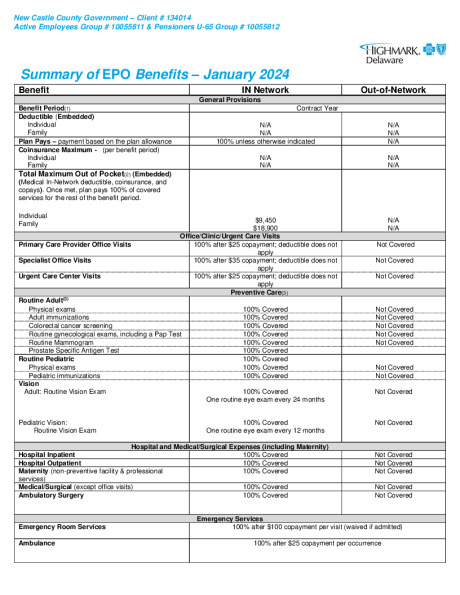

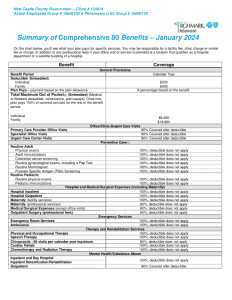

Highmark Plans

Aetna Plan

Prescription Plan

CLICK HERE to view the Prescription Plan page for Retirees Under 65.

Over 65

Retirees over 65 along with their spouse and or dependent children are eligible for the benefits described below.

- Medical (spouse, and/or children up to age 26)

- scroll down for medical plan information

- Dental (spouse and/or children up to age 26)

- click here for the Dental Plan page

- Vision (spouse and/or children up to age 26)

- click here for the Vision Plan page

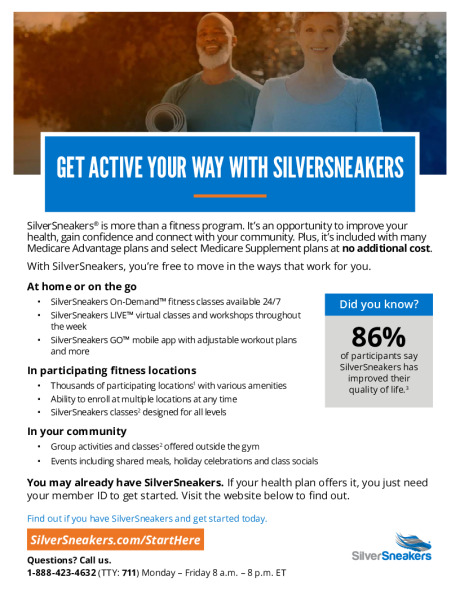

Aetna Medicare Advantage: Video

Medicare Information

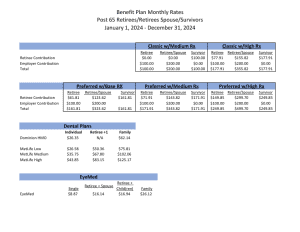

2024 Monthly Rates Post 65

Aetna Preferred Medical Plans

Summary of Benefits

Aetna Classic Medical Plans

Summary of Benefits

Qualifying Life Event

Certain life events provide you a 30-day window to elect benefits or change your covered dependents.

What is a Qualifying Life Event? If you experience any of the scenarios below, you may be eligible to update your benefit elections mid-year:

- Marriage, divorce, or legal separation

- Birth or adoption of a child

- Commencement or termination of adoption proceedings

- Change in child’s dependent status

- Death of a dependent

- Loss or gain of other health coverage for you and/or dependents

- Change in employment status

- Change in Medicaid/Medicare eligibility for you or a dependent

- Receipt of a Qualified Medical Child Support Order

Remember, dependent verification will be required.

If you have questions about your eligibility or enrollment process, contact HR benefits 302-395-5180 or HRbenefits@newcastlede.gov