Which Medical Plan is Right?

Evaluate Your Needs. Consider your prior health care usage and select plans and options that fit your lifestyle and needs.

- Do you take regular prescription medications?

- Are you anticipating surgery or non-preventive dental care?

- Did you experience a qualifying life event this year?

- Review your current plans to ensure you have the coverage you need.

Review this benefits website to learn about your plan options.

A little bit of planning will help you select the best plans, coverage levels, and financial programs for your unique situation.

Medical Plan Comparison

New Castle County will continue to offer medical coverage. The below charts are a brief outline of the plan options.

Please CLICK HERE or scroll down for the Aetna or BCBS Retiree Plan.

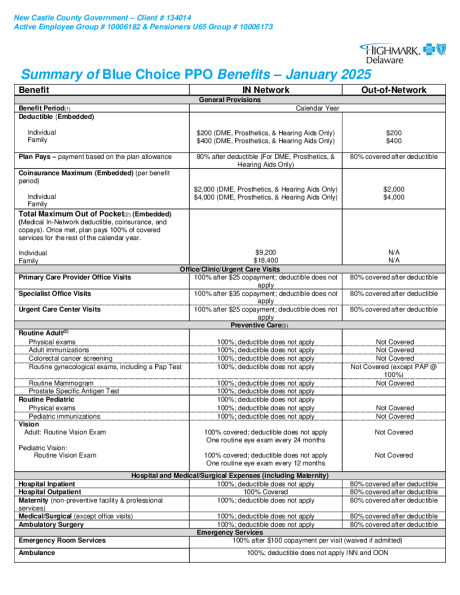

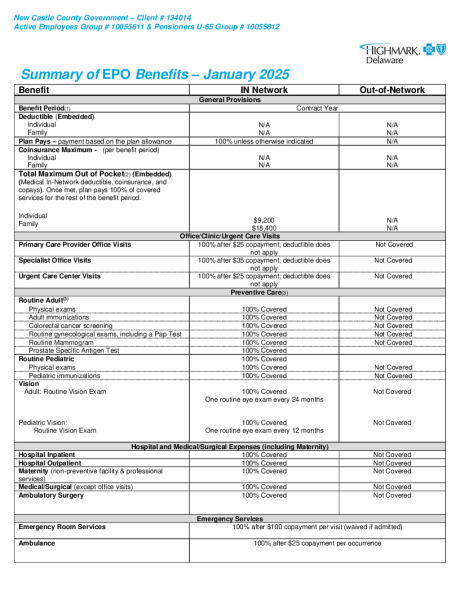

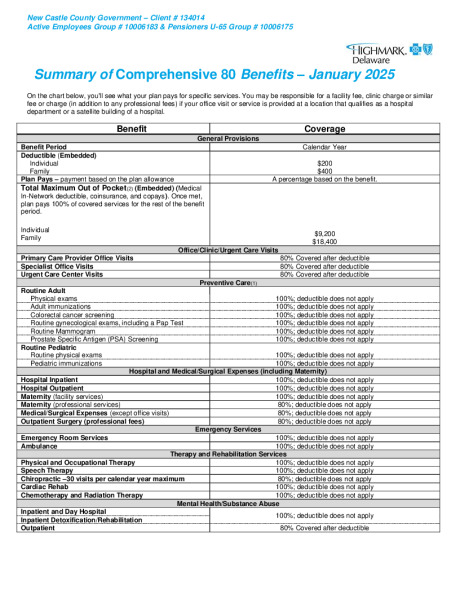

Highmark BlueCross BlueShield Plans

| Highmark Blue Cross Blue Shield Highmark PPO |

Highmark Blue Cross Blue Shield Highmark EPO |

Highmark Blue Cross Blue Shield Highmark Comp 80 |

||||||

|---|---|---|---|---|---|---|---|---|

| In-Network Benefits |

Out-of-Network Benefits |

Schedule of Benefits | Schedule of Benefits | |||||

| Annual Deductible | ||||||||

| Individual | $200 | $200 | $0 | $200 | ||||

| Family | $400 | $400 | $0 | $400 | ||||

| Coinsurance | 100% | 80% | 100% | 80% | ||||

| Maximum Out-of-Pocket | ||||||||

| Individual | $9,200 | N/A | $9,200 | $9,200 | ||||

| Family | $18,400 | N/A | $18,400 | $18,400 | ||||

| Physician Office Visit | ||||||||

| Primary Care | $25 copay | 80% after deductible | $25 copay | 80% after deductible | ||||

| Specialty Care | $35 copay | 80% after deductible | $35 copay | 80% after deductible | ||||

| Preventive Care | ||||||||

| Adult Periodic Exams/ Well Child Care | 100% | Not covered | 100% | 100% | ||||

| Diagnostic Services | ||||||||

| X-ray and Lab Tests | 100% | 80% after deductible | 100% | 100% | ||||

| Complex Radiology | 100% | 80% after deductible | 100% | 100% | ||||

| Urgent Care Facility | $25 copay | 80% after deductible | $25 copay | 80% after deductible | ||||

| Emergency Room Facility Charges | $100 copay per visit; waived if admitted | $100 copay per visit; waived if admitted | $100 copay per visit; waived if admitted | 100% | ||||

| Inpatient Facility Charges | 100% | 80% after deductible | 100% | 100% | ||||

| Outpatient Facility and Surgical Charges | 100% | 80% after deductible | 100% | 100% | ||||

| Mental Health | ||||||||

| Inpatient | 100% | 80% after deductible | 100% | 100% | ||||

| Outpatient | 100% | 80% after deductible | 100% | 80% after deductible | ||||

| Substance Abuse | ||||||||

| Inpatient | 100% | 80% after deductible | 100% | 100% | ||||

| Outpatient | 100% | 80% after deductible | 100% | 80% after deductible | ||||

| Retail Pharmacy (30 Day Supply) | ||||||||

| Generic | $8 copay | Not covered | $8 copay | 20% after deductible | ||||

| Preferred | $30 copay | Not covered | $30 copay | 20% after deductible | ||||

| Non-Preferred | $50 copay | Not covered | $50 copay | 20% after deductible | ||||

| Mail Order Pharmacy (90 Day Supply) | ||||||||

| Generic | $16 copay | Not covered | $16 copay | 20% after deductible | ||||

| Preferred | $60 copay | Not covered | $60 copay | 20% after deductible | ||||

| Non-Preferred | $100 copay | Not covered | $100 copay | 20% after deductible | ||||

Note: Please consult plan documents for full benefits, exclusions, and limitations.

Medical Insurance (continued)

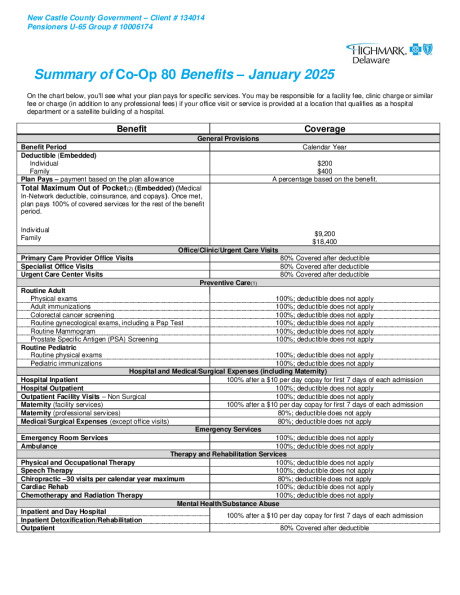

Highmark BlueCross BlueShield Plans

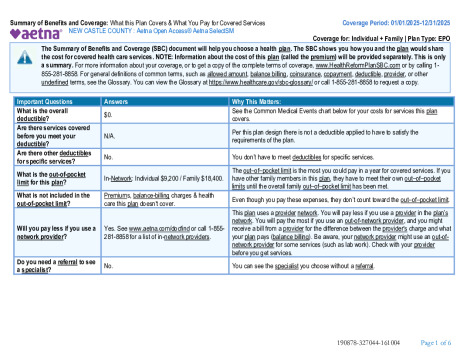

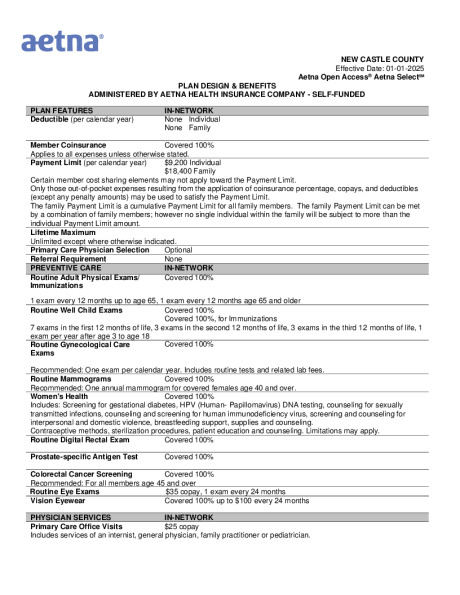

| Aetna Open Access Select | Highmark Blue Cross Blue Shield Highmark Co-Op 80 (Retiree Only) |

|||

|---|---|---|---|---|

| Schedule of Benefits | Schedule of Benefits | |||

| Annual Deductible | ||||

| Individual | $0 | $200 | ||

| Family | $0 | $400 | ||

| Coinsurance | 100% | 80% | ||

| Maximum Out-of-Pocket | ||||

| Individual | $9,200 | $9,200 | ||

| Family | $18,400 | $18,400 | ||

| Physician Office Visit | ||||

| Primary Care | $25 copay | 80% after deductible | ||

| Specialty Care | $35 copay | 80% after deductible | ||

| Preventive Care | ||||

| Adult Periodic Exams | 100% | 100% | ||

| Well-Child Care | 100% | 100% | ||

| Diagnostic Services | ||||

| X-ray / Lab Tests | 100% | 100% | ||

| Complex Radiology | 100% | 100% | ||

| Urgent Care Facility | $25 copay | 80% after deductible | ||

| Emergency Room Facility Charges | $100 copay; waived if admitted | 100% | ||

| Inpatient Facility Charges | 100% | $10 copay per day for first 7 days then 100% | ||

| Outpatient Facility and Surgical Charges | 100% | 100% | ||

| Mental Health | ||||

| Inpatient | 100% | $10 copay per day for first 7 days then 100% | ||

| Outpatient | 100% | 80% after deductible | ||

| Substance Abuse | ||||

| Inpatient | 100% | $10 copay per day for first 7 days then 100% | ||

| Outpatient | 100% | 80% after deductible | ||

| Other Services | ||||

| Chiropractic | 80% after deductible; 30 visits per year | 80%; 30 visits per year | ||

| Retail Pharmacy (30 Day Supply) | ||||

| Generic | $8 copay | 20% after deductible | ||

| Preferred | $30 copay | 20% after deductible | ||

| Non-Preferred | $50 copay | 20% after deductible | ||

| Mail Order Pharmacy (90 Day Supply) | ||||

| Generic | $16 copay | 20% after deductible | ||

| Preferred | $60 copay | 20% after deductible | ||

| Non-Preferred | $100 copay | 20% after deductible | ||

Note: Please consult plan documents for full benefits, exclusions, and limitations.

Highmark Plans

Aetna Plan

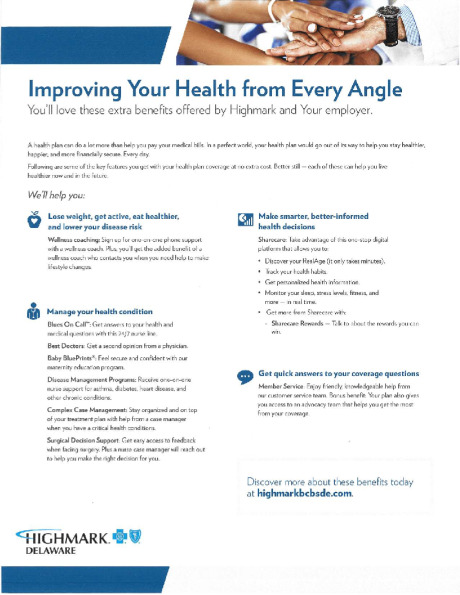

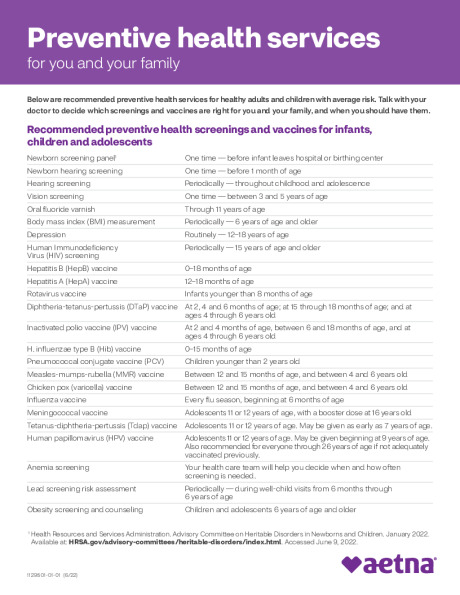

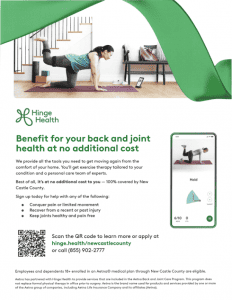

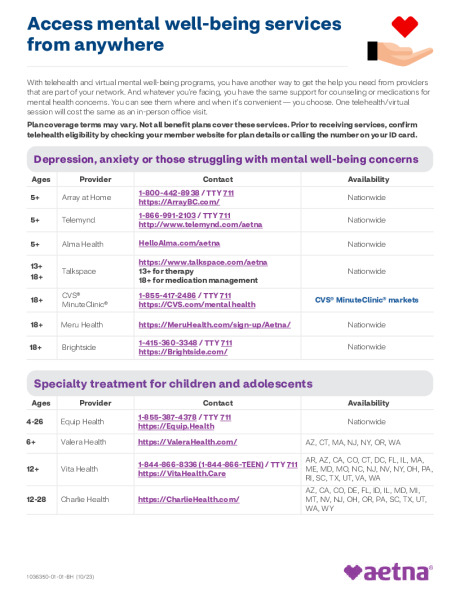

Additional Benefits

Use Teladoc to get the care you need

Teladoc® gives you access to a national network of U.S. board-certified doctors by phone or video. They’re available anywhere and anytime to treat many of your medical issues.

Teladoc doctors can help with many medical conditions, including:

• Cold and flu symptoms

• Allergies

• Sinus problems

• Sore throat

• Respiratory infection

• Skin problems

1-855-Teladoc (1-855-835-2362)